Debt consolidation means that you convert your multiple debts into a single loan by combining them. It aims to make repayment easy and manageable. When many people get entangled in credit cards, personal loans, medical bills, or other financial obligations, it becomes difficult for them to make multiple payments every month. Therefore, they opt for a debt consolidation option where they combine all their debts and take one loan, and gradually clear all the debts with that single payment. In this process, people often take loan from a new lender or choose the balance transfer option and pay off their old high-interest loans. People prefer this method for this reason.

They do this because it gives them a fixed monthly payment, and budgeting becomes easy, but it is not effective for everyone. Therefore, it is explained in the introduction how this concept works and why people consider it. It is just a financial tool which can give benefits if used wisely; otherwise, it can also cause loss due to misuse or wrong planning. Everyone should take this step after thinking about their financial goals and situation so that they get stability in the long term and can fulfill their obligations without any stress.

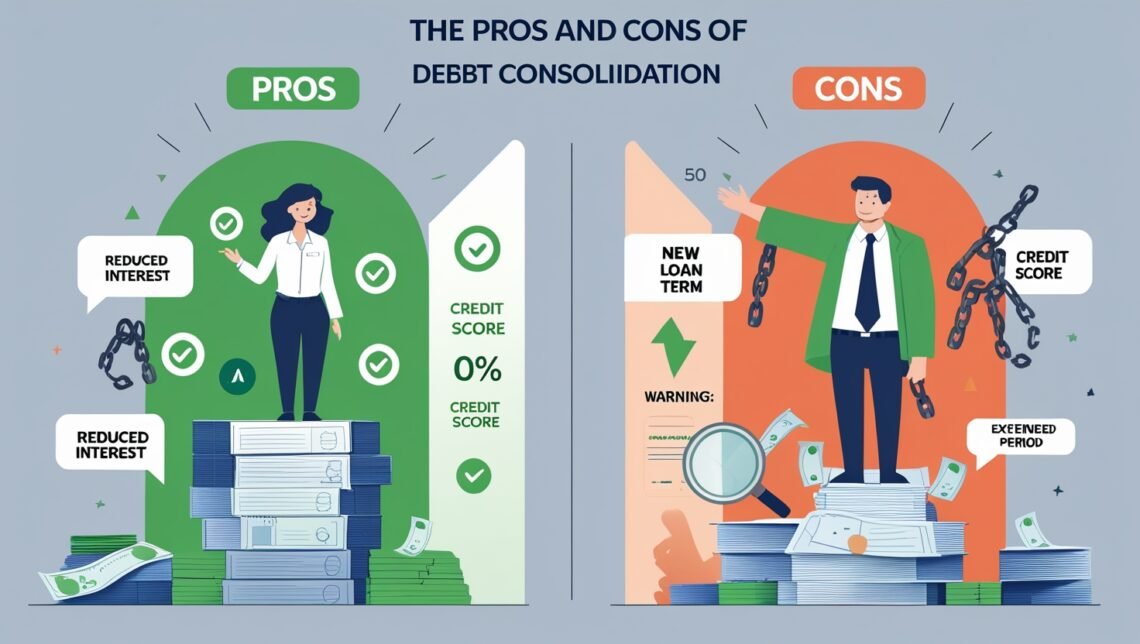

2. Pros – Simplified Repayment and Better Financial Management

When someone has multiple debts, it becomes difficult to understand and manage them according to different dates, amounts, and interest rates. In this situation, debt consolidation comes as a solution where multiple payments are merged to make a single monthly payment. This way, the borrower has to focus on just one payment every month. This saves time and reduces the chances of mistakes. Many people pay their bills on time using this method, and their credit score gradually improves. When repayment is simplified, financial stress reduces, and a person can plan their budget more effectively using this method. Through this, people create a structured repayment schedule and pay their debts with discipline.

This section explains how simplified repayment can become a powerful tool for people who are facing confusion and pressure in their finances When only one payment is taken care of, a person can manage his monthly income better and can also avoid spending on unnecessary things This approach is very useful for people who want to get rid of their debts stably and predictably and want their financial system to be orderly and stress-free.

3. Pros – Lower Interest Rates and Improved Credit Score Potential:

Another advantage of debt consolidation is that people often convert their old high-interest loans or credit card debts into a new low-interest loan through this process. This means that they pay less interest overall and their repayment process becomes efficient. When a person has a good credit score, they can take a consolidation loan at a much better interest rate. This also reduces his monthly payment, and he can repay his debts faster. Along with this, when you make timely and consistent payments, your credit score also improves. Credit score is an important indicator of any person’s financial health. And when it improves, it becomes easier for you to take loans, insurance, or enter into rental contracts in the future. This section explains how debt consolidation reduces your financial burden by giving you the benefit of lower interest rates and also increases your credibility.

This process is especially helpful for people who have made late payments in the past and now want to improve their credit history. If you make payments with commitment and discipline, you see gradual improvement, which leads you towards long-term financial stability and growth.

4. Cons – Risk of Accumulating More Debt after Consolidation;

When a person consolidates his entire debt, he feels that now his burden has reduced, but the real problem begins when he starts using his freed-up credit cards and lines of credit again. If the spending habits remain the same, then there is no benefit of debt consolidation because a new loan also has to be repaid, and if old borrowing habits also come back along with it, then the overall debt increases. This is why many people who feel financially relaxed after consolidation become careless and again get involved in unnecessary shopping or overspending.

Yes, this section explains how discipline and budgeting are necessary even after consolidation. If you do not change your lifestyle and financial behavior, the debt comes back, and sometimes it becomes even more. To avoid this risk, people must consider debt consolidation as an opportunity rather than a relief. At this time, they should change their habits and plan their financial goals realistically; otherwise, they are only taking temporary solutions whose long-term outcome will still become a burden.

5. Cons – Fees, Loan Terms, and Potential Higher Long-Term Costs:

Debt consolidation often comes with hidden charges that people do not notice initially. Sometimes lenders charge application fees, processing charges, or early repayment penalties that increase the overall cost. Also, if the tenure of the consolidation loan is longer, the monthly payment may be less, but you pay more interest overall. This proves to be expensive in the long term. Many people take such loans just to see the monthly relief, but they should understand that increasing the period means that they will remain in debt for a longer period and pay a higher total amount.

This has been highlighted in this section. It is very important to understand the loan terms properly before consolidating the loans. Not every loan is the same, and the policies of every lender are different. Therefore, considering only one payment as convenient and using it can be futile if there are hidden costs or unfavorable terms with it. Therefore, every borrower should compare, take transparent details, and take advice from a financial advisor so that they can make an informed decision, which will be beneficial for them in the long term rather than becoming a burden.

6. Conclusion:

This entire blog concludes that debt consolidation can be a powerful financial tool, but only for those people who use it after understanding it. If you are disciplined and can control your spending habits, then it can give you relief and help you get out of your debts. But if you are only looking for short-term relaxation and have plans of borrowing again in the future, then it will again take you into the same cycle from which you are trying to get out. Therefore, it is emphasized in this conclusion that you should deeply analyze your financial goals, budgeting discipline, and spending style.

You should decide on debt consolidation only after that. If you go into this process with a proper plan by thinking realistically, you can reduce your financial stress, improve your credit profile, and move towards a safer future. But if you are only looking for an easy solution without changing your habits, this method will only provide temporary relief, and you will again feel the same stress. Therefore, understanding and commitment are the most important things when you decide to go for debt consolidation.