What Are Small Amount Payments?

Small amount payments refer to transactions involving relatively low monetary values, typically under a predetermined threshold. These payments can encompass various forms, such as micropayments for digital content, utility bills, or even tipping services. The precise definition of what constitutes a “small amount” may vary depending on context, industry standards, or consumer preferences. As digital economies evolve, the significance of small amount payments has surged, primarily fueled by the increasing reliance on online platforms and mobile payment solutions. By lowering the barrier to transaction participation, these payments make it easier for individuals to access goods and services that they might otherwise overlook due to high costs.

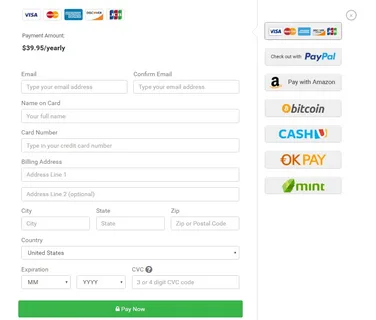

The Rise of Digital Wallets and Payment Platforms

The proliferation of digital wallets and payment platforms has played a pivotal role in facilitating small amount payments. Services such as PayPal, Venmo, and various cryptocurrency wallets have simplified the payment process, allowing users to send and receive money with just a few clicks. These platforms often come with minimal transaction fees, making them ideal for small amount transactions. Additionally, the convenience of mobile payments through smartphones has enabled consumers to conduct transactions on the go. As a result, small amount payments have become an integral part of everyday transactions, ranging from purchasing a coffee to paying for digital content like songs or e-books.

Benefits of Small Amount Payments

Small amount payments offer numerous benefits for both consumers and businesses. For consumers, they provide access to affordable products and services without the need for large sums of money upfront. This accessibility fosters a culture of experimentation, encouraging individuals to try new services or products they might not typically purchase. For businesses, accepting small amount payments can lead to increased sales volume and customer engagement. It allows businesses to tap into new revenue streams by offering low-cost options, attracting a broader customer base. Furthermore, with advancements in technology, businesses can streamline their payment processing systems, reducing overhead costs associated with traditional payment methods.

Challenges and Considerations

Despite their advantages, small amount payments also come with challenges. One significant hurdle is the transaction fees associated with processing these payments. Even minor fees can become disproportionate relative to the payment amount, making some transactions unprofitable for businesses. Additionally, security concerns can deter users from engaging in small amount transactions, as they may worry about the potential for fraud or misuse of their financial information. Businesses must invest in robust security measures to safeguard transactions and build consumer trust. Furthermore, regulatory issues, such as compliance with financial regulations, can complicate the implementation of small amount payment systems. Addressing these challenges is crucial for maximizing the potential of small amount payments in today’s digital economy.

In conclusion, small amount payments are transforming the way consumers and businesses engage in transactions. Their convenience, accessibility, and potential for increased revenue make them an appealing option in an increasingly digital world. However, addressing the challenges associated with these payments is essential for sustaining their growth and ensuring that both consumers and businesses can enjoy the benefits they offer.상품권카드